How Nigeria’s 2026 Tax Reforms Affect Your Income, Business, and Crypto

- Business

- 22.09.2025

- No Comment

- 127

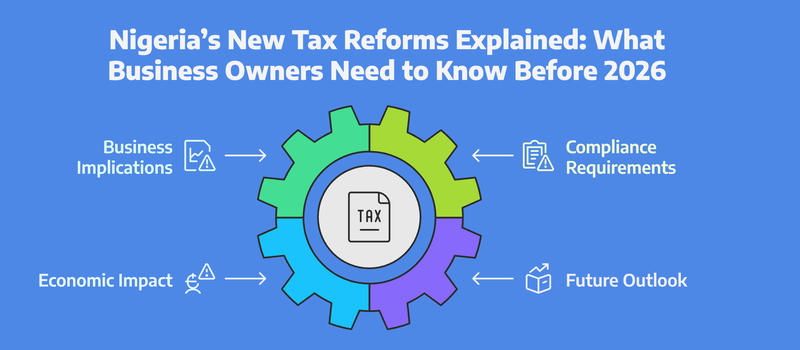

2026 Tax Reforms Nigeria has introduced a comprehensive tax reform that will take effect on

January 1st, 2026. These reforms are designed to simplify tax compliance,

reduce the burden on individuals and businesses, and adapt to modern economic realities,

including the cryptocurrency market.

In this article, we will explore what these reforms mean for you as an

individual earner, business owner, or crypto investor. Please note, this is

for educational purposes only and should not be considered professional tax or

financial advice. Always consult a qualified tax adviser.

Key Highlights of the 2026 Tax Reforms

- Personal income below ₦800,000 is tax-free.

- Companies with annual turnover below ₦50 million pay no corporate tax.

- To enjoy tax relief, individuals must now invest in specific financial products.

- Crypto profits above ₦800,000 are taxable, while holding or losses remain tax-free.

- New emphasis on digital financial tracking and compliance.

Tax Avoidance vs Tax Evasion

It’s important to distinguish between the two:

- Tax avoidance is legal—it involves using government-approved methods such as

retirement savings or insurance contributions to reduce your tax liability. - Tax evasion is illegal—it means concealing income or falsifying records.

Under the old system (until December 31, 2025), every taxpayer automatically received

20% of gross income plus ₦200,000 (or 1% of gross income) as relief.

Starting 2026, this is no longer automatic—you must make qualifying investments to

enjoy deductions.

Eligible Investments for Tax Relief

- Contributions to a Retirement Savings Account.

- Purchasing life insurance for yourself or your spouse.

- Contributions to the National Health Insurance Scheme.

- Payments into the National Housing Fund.

- Rent payments attract 20% relief, capped at ₦500,000.

Practical Scenarios

Unemployed Individual Receiving Remittance

If you receive $100 (~₦100,000) from abroad, you pay no income tax since it is

below the ₦800,000 threshold. However, you may still pay VAT and electronic transfer charges.

Crypto Transactions

- Buying BTC with ₦100,000 and selling for ₦200,000: Profit = ₦100,000 (no income tax since below ₦800,000).

- Buying BTC with ₦100,000 and selling for ₦2,000,000: Profit = ₦1.9M (taxable since above ₦800,000).

- Trading crypto under a company name with turnover below ₦50M: No company income tax, but VAT and transfer charges apply.

Business Turnover

If your registered company’s annual turnover is below ₦50 million, you are exempt

from corporate income tax. But you must still comply with VAT, electronic transfer duties, and

record-keeping obligations.

How Assets and Investments Are Taxed

- Crypto Assets: Holding or losses = no tax. Selling at a profit = taxable. Staking rewards = taxable.

- Bank Accounts: No tax on balances. Interest earned is taxable.

- Bonds: Federal Government bonds are tax-exempt.

- Insurance: Premium payments are tax-free.

- Retirement Savings: Contributions, growth, and withdrawals are all tax-free.

- Rent: Eligible for 20% relief, capped at ₦500,000.

- Stocks: Holding = no tax. Selling at a profit = taxable.

- Gifts & Inheritance: Generally not taxable.

How to Prepare for 2026

- Seek tax advice: Hire a professional accountant or tax consultant.

- Keep receipts and documentation: Store both digital and paper records.

- Use electronic payments: Minimise cash transactions to maintain an audit trail.

- Stay compliant with NRS: The new Nigeria Revenue Service will use

digital data for tax monitoring.

Frequently Asked Questions (FAQ)

1. When do the new tax laws take effect?

The laws take effect from January 1, 2026.

2. How do they affect businesses?

Companies with turnover under ₦50 million are exempt from corporate income tax but must still

comply with VAT and other levies.

3. How are crypto transactions taxed?

Profits above ₦800,000 are taxable. Holding crypto or selling at a loss is not taxed.

Staking rewards are taxable.

4. Are all bank transfers taxable?

Not directly. Tax is based on income generated (e.g., interest or profits),

not account balances. However, transaction records may be reviewed by authorities.

5. Can I reduce my taxable income?

Yes, by contributing to retirement accounts, health insurance, life insurance, housing funds,

and paying rent (up to ₦500,000 relief cap).